Pick the right accounting software for your small business

I get this question a lot, maybe its because I am an accountant/bookkeeper, maybe its because of my IT background, or just people don’t really know.

I don’t think there is any one answer for people it really depends on your needs. Read on for some tips that may help you decide.

Synoptic Journal

This is a paper based ledger, you may have seen them it is large binder with a page for each month. This is the ultimate in low tech. Don’t really see these too much anymore but you can still buy the ledger books.

Best for – someone who doesn’t want to use a computer. Very inexpensive.

Drawback – It might be hard to find an accountant to work with a paper based system. It is also easy to make mistakes. It also really only tracks income and expenses so your accountant will have to have a system to track any balance sheet items like equipment, loans etc separately.

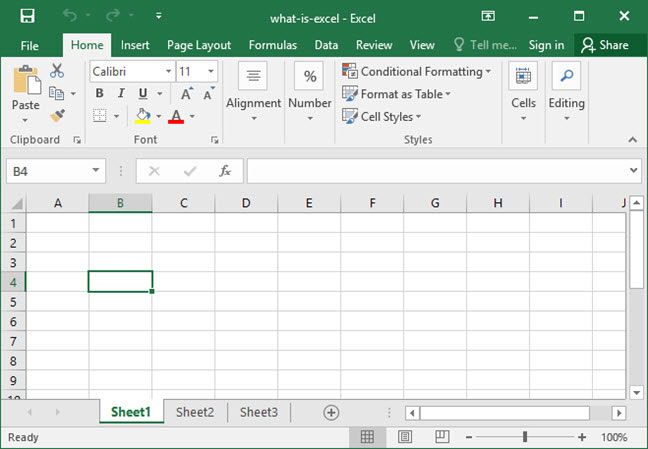

Excel

This is typically an computer version of the synoptic journal. These usually come from smaller businesses who have simple needs. Think consultant or a small service provider.

Best for – business owners with a simple, low volume business. Because it is excel it is easy to find templates online and easy to add up the numbers.

Drawback – It is excel and this type of accounting method doesn’t scale well if your business gets complicated. While there are more options to track the balance sheet items, typically like a synoptic journal these are tracked separately at tax time.

Desktop Software

Accounting software for the desktop has been around for a very long time. While most of the accounting software providers are encouraging migrating to the cloud, there is still a large component of businesses who prefer to work on the desktop. The most common ones are Sage 50 and QuickBooks Desktop but there are a number of ‘free’ or ‘almost free’ options. A few like Sage 50 cloud and AccountEdge are ‘hybrid’ which have a desktop component but ‘sync’ to the cloud.

Best for – Bookkeepers or businesses that have multiple companies and individuals who don’t want to work in the cloud. Because of the need to roll out updates, the software is more consistent to use and changes to the software can be managed. As it is on your desktop theoretically it can be used where there is no internet (however some companies require an internet connection to verify licensing). Many bookkeepers prefer desktop software because of the ability to pay once and use it for multiple companies.

Drawbacks – Can be challenging to share the software, updates and backups have to be managed by the end user. The software is ‘tied’ to a specific computer and typically there is a process to setup a new computer.

Cloud Based software

This is the newest advance in accounting methods. Xero was the first main cloud accounting software (CAS) provider first launching in 2006. QuickBooks started offering cloud accounting software in the early 2000s and Sage offered an online version in the mid 2010s. There are other cloud accounting software providers like Zoho, Wave, Freshbooks, Odoo to name a few but Xero and QuickBooks are the most popular.

Best for – Businesses who want to work in the cloud and be location independent. It is easy to share the software with team members and accountants. Various apps are available to extend the functionality of the software and reduce the amount of manual data entry. Backups and updates are managed by the software provider. The software can be used in any location and isn’t tied to a specific computer.

Drawbacks – each company is setup individually so there can be more cost for the accounting software. There is no control to how often changes are made or features updated, and this can be frustrating to the person using the software. An internet connection is mandatory to be able to use cloud accounting software.

Summary

So there are a lot of options when deciding the accounting method that works for you. Your method may end up being decided by the accountant or bookkeeper you use. Just remember regardless of the method, most tax authorities require you to keep a copy of your business receipts for 7 years. How you do that is outside the scope of this post but watch for another post on ways to store business document receipts.

Not sure which is the best method for your small business? Reach out and we can help you decide.

Proudly Canadian

Accounting MD is proudly 100% Canadian. All service providers are accredited Canadian Financial Professionals. No portion of our work is outsourced outside of Canada.